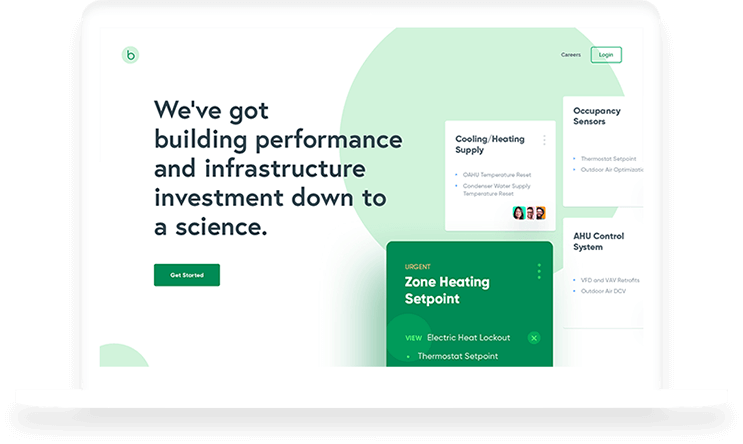

Navigate Compliance with confidence and ease

Locate your compliance issues, before they become issues.

Commercial Banks and UCBs love our Compliance Toolset

RBI Compliance Toolset

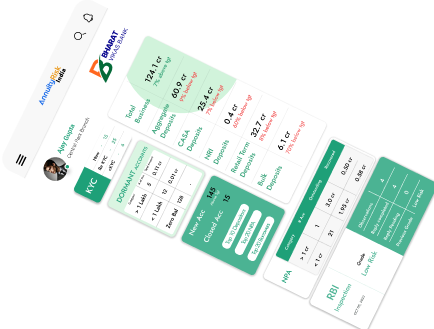

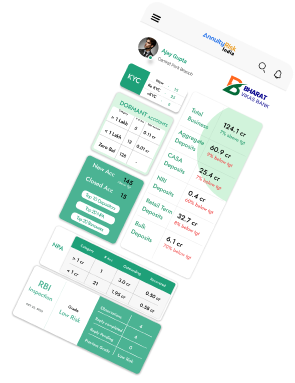

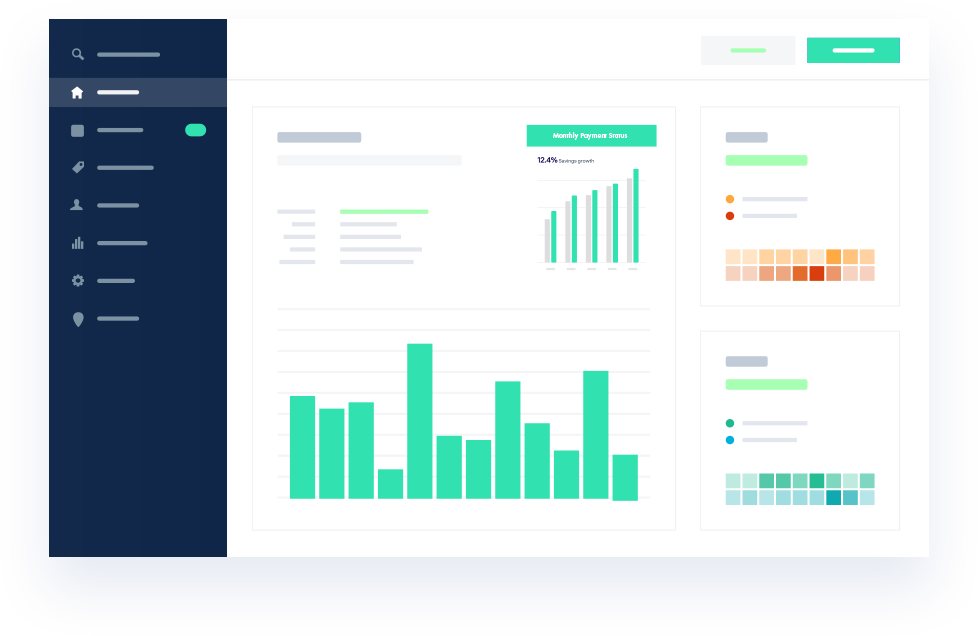

KYC

End-to-end KYC vigilance framework to monitor customer onboarding, profile updates, transactions and risk categorization.

Fraud Detection

AI enabled alerts for detection of suspicious transactions and fraud. Timely prioritization and reporting of events.

CRR and SLR

Continuous and comprehensive monitoring of key risk metrics and maximization of capital efficiency.

UCBs - Inter-bank deposits, SAF and more

UCB focused solution for monitoring and optimizing inter-bank deposits, asset quality, CRAR and other key metrics.

Statutory Compliance for Loans - NPA and more

AI enabled monitoring of asset quality and predicton of asset deterioration. Full compliance with statutory restrictions.

Branch Level Diligence

Empower branch managers with the tools they need for full compliance – covering interest payments, fees, dormant accounts, min balance and more.

Trusted by over 30,000 companies.

Subscribe Newsletter